Retail outlet centers offer a more attractive alternative to shopping malls for consumers, retailers and real estate owners alike. In this post, we look at the data to understand why.

Retail consumer preferences have shifted over the last decade toward value, cost-consciousness and discount-based consumption. Coupled with the explosion of ecommerce, two-day shipping and the 300-pound gorilla that is Amazon, this has led to the well-publicized (and still ongoing) decline of the retail sector. And, in particular, shopping malls.

Despite the implosion, there’s still a place for the kind of regional brick and mortar shopping experience once dominated by malls. And one kind of property is well-positioned: factory retail outlet centers.

The Case for Outlets

Outlet centers create a value proposition ranging from the perception of discounted merchandise, a good value (i.e., designer goods at cheap prices), a day-trip destination, in some cases tax-free shopping, and a less stressful experience than going to the mall. This makes it attractive to consumers.

For retailers, outlets present a chance to re-engage with consumers, offer a brand name experience at a better price and save on occupancy costs.

For real estate owners, outlet centers offer a cheaper physical structure relative to a mall (i.e., no large enclosed space which must be finished, furnished, climate controlled, etc.), no significant dependencies on large anchor boxes with weak tenants, and the ability to reconfigure spaces faster and more easily.

Development trends seem to be in agreement as well.

Shopping Malls vs. Retail Outlets

Heading into 2005, US developers had built over 1,500 shopping malls. Occupancy costs for tenants with sales of $300/ft could be 13%-14% according to Moody’s, with costs rising to 16% for sales over $350/ft.

In contrast, today, there are around 215 outlet malls, or less than 20% of the number of malls. Occupancy costs at outlets appear to average 9%-12%. Over the past 8 years, an average of 5 centers are delivered each year, with that number falling to just 1 in 2018 according to materials from Tanger Outlets.

All of that sounds positive for the outlet center as an asset class. But what makes any particular outlet center successful?

What Makes an Outlet Successful?

The “outlet experience” is one of the key draws for consumers, with store selection an important additional driver. But the most important success factor, as with anything in real estate, is location. Well-placed centers can attract traffic already in the area as opposed to the center being the sole day trip destination. They can also offer a more diverse product selection because they don’t have to depend on a single “anchor” type tenant.

Outlets by the Numbers

Well-placed centers can generate 1.5x the sales of an average and similarly tenanted center in a more remote location. Further, the better located centers can see valuations of more than 2.0x per foot than other centers. Our research indicates sales of $500/ft at the higher end of all the centers currently available via CMBS conduit deals and ranging to $286/ft at the lower end. Tanger Outlets, the second largest operator in the US, reports average sales of $385/ft across their 44-center portfolio. Value Retail News reported in 2015 that the top 20 centers can average sales of over $1,000/ft.

Outlet Study: Are Well-Placed Outlets More Valuable than Destination Outlets?

We reviewed approximately 40 outlet centers whose debt is securitized via CMBS conduit transactions to determine if our assumption about key factors was correct.

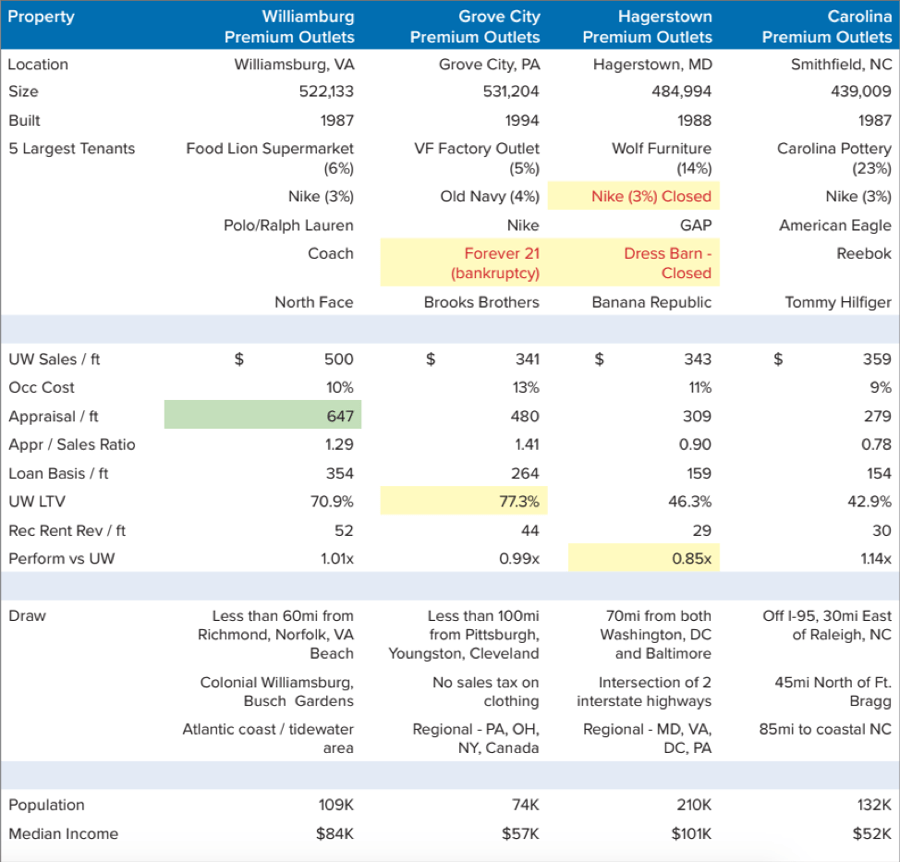

In Table 1 we present some key findings from a representative sample of four centers: Williamsburg Premium Outlets, Grove City Premium Outlets, Hagerstown Premium Outlets, and Carolina Premium Outlets.

All four centers are owned by the same sponsor (Simon Properties) and have a similar tenant base. For example:

- Each has two “designer” outlet stores (Calvin Klein, Polo, Ralph Lauren, etc.)

- Each has approximately 60% (by count) other clothing / shoe outlets

- Each has approximately 10%-12% (by count) accessories outlets

- Each has approximately 10%-12% (by count) food related stores

The Destination Outlets

Looking deeper, note that from a physical space perspective, Grove City, Hagerstown, and Carolina are located between urban and rural areas with a manufacturing or military employment base. None of the three are surrounded by a “destination” area. The outlet center is the primary destination. Both Hagerstown and Carolina have relatively large exposures to a lead tenant, Wolf Furniture (14%) and Carolina Pottery (26%) respectively. Both appear to be additional “draws” for consumers to make the trip.

The Well-Placed Outlet

The Williamsburg center is surrounded by an area which is considered a stand-alone destination. The Williamsburg, VA area draws thousands of visitors annually to the Colonial Williamsburg, Jamestown, and Yorktown historical area. Additional draws are the College of William and Mary, proximity to the Greater Hampton Roads area, Virginia Beach, and coastal Virginia, the Busch Gardens theme park, and an Anheuser Busch brewery. The Williamsburg area is also in close proximity to the major military installations of Naval Station Norfolk, Langley Air Force Base, Naval Air Station Oceana, and Newport News ship building. In addition to the military population, the Williamsburg area also has a large retirement community.

Interestingly, the population base near the Williamsburg center is smaller than both Hagerstown and Carolina. The median income at Williamsburg is also lower than the Hagerstown center. The smaller population and second highest income combined with the comparability of the tenants, and the same sponsorship leads us to the conclusion that visitors and non-outlet “destination” travelers generate a significant amount of traffic at Williamsburg.

Sales & Valuations

That difference is material and helps explain why such a wide variance can exist. Williamsburg delivers 1.5x the sales volume, reaching approximately $500/ft at underwriting. That multiple of sales volume drives valuations to nearly $650/ft (at UW appraisal) which is 35% higher than Grove City, 2.0x the valuation of Hagerstown, and 2.3x the value of Carolina.

Table 1

Conclusion

The numbers in this study indicate well-placed outlet centers are a worthwhile investment. They pull more traffic, offer better product selection and don’t have to depend on anchor tenants. As a result, they generate more sales, driving valuations to more than double PSF what an average center can achieve.

The case is clear. CRE investors shouldn’t ignore retail outlets. Consumers, retailers and property owners certainly aren’t.